Mudra Loan to Start Pharma Business – Micro Units Development & Refinance Agency Limited (MUDRA) or Pradhan Mantri MUDRA Yojana (PMMY) is popular refinancing and support scheme for the non-farm small/micro enterprises and non-corporate. It was initiated by our honorable Prime Minister The purpose of this government scheme April 15 ‘2016. This purpose of this scheme is to provide support for the creation of employment and income generation. Primarily, if you are a pharma businessman or want to start out a venture in this sector but finance or monetary funds are the biggest obstacles then apply for Mudra Loan Yojna Y to start pharma business/ Pharma Franchise. It is the most accessible and affordable credit system with the genuine interest rate for new startup owners and on-going pharma business person.

To know detailed information about our offered drug range, feel free to contact us anytime through. We are always able to provide you with our values on call +91 9814333399.

What Is Pradhan Mantri MUDRA Yojana (PMMY)?

With a motto of “fund the unfunded”, a flagship scheme was introduced by our respected PM, Narendra Modi ji as a way to financial support the micro-unit/ individuals of various industries indulged in services, manufacturing, allied activities, retail, and agri etc. The loan can be sanctioned and available via Commercial Banks, Cooperative Banks, Small Finance Banks, MFIs, RRBs, and NBFCs. The maximum loan that can be availed from this scheme is Rs 10 Lakhs (T&C applied). Under this scheme, you can avail the loan in three slabs which are based on phases of business i.e.

- Shishu: Loan up to Rs 50, 000

- Kishore: Loan Between Rs 50, 000 to Rs 5 Lakhs

- Tarun: Loan varying from Rs 5 Lakhs to 10 Lakhs

How Is Mudra Loan Beneficial for Pharma Businessmen?

Starting your own business in the pharmaceuticals business requires genuine investments. Many times or due to the lack of funding, the business venture get halted which can have a negative impact. You can apply for this credit scheme and make your workings smooth. In case you have exhausted a lot of your investments then this scheme is a table turner. The benefits of applying for Mudra loan are varied. Take a look at the following:

Assets created out of the Bank’s finance.

Collateral security free loans.

No processing fee

The loan helps in qualifying for the next phase of growth/ graduation of the business stage.

Affordable credit and interests on loans (varying from bank to bank)

The best part, everyone is eligible irrespective of the occupation you hold right now. If you have the vision in mind then Mudra loan is here to support your dream.

How To Apply For Mudra Loan or Pradhan Mantri MUDRA Yojana (PMMY)?

You can visit your nearest bank offering MUDRA loan to apply. HDFC Bank, IndusInd Bank, UCO Bank, State Bank of India and Axis Bank holds the maximum number of MUDRA accounts and has sanction millions of loans to people under this scheme. Pharma people can apply for Business Installment Loan (BIL) or Business Loans Group Loans (BLG) and Rural Business Credit (RBC) – whatsoever suits your needs and bank requirements.

- You need to be prepared with all the required documents along with a convincing business plan.

- Approach one or more banks offering this loan. It is due to the difference of terms, conditions, and rate of interest offered by banks.

- Processing of loan will take place.

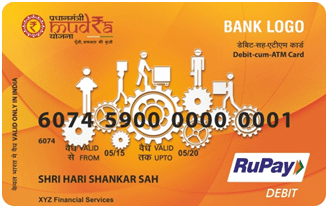

- If your application is accepted, then your loan will be sanctioned and you will be provided with the Mudra card*.

Note: Mudra Card is a RuPay card that offers hassle-free credit facilities via Cash Credit or Over Draft which can be drawn from ATM or Point of Sale credit card swiping machines purchases. It is also helpful in reducing interest burden by allowing repayment of the amount when surpluses are available.

Documents Required by Pharma Business Person To Apply for Mudra Loan

Pharma people who intend to start a pharma franchise business or PCD pharma franchise in India can easily avail of this loan. It is quite feasible for those franchise vendors who have a flourishing business stage but are facing financial issues. You can apply for this loan. Some of the main documents required by the banks are as follows:

- MUDRA Loan Application or apply online via Mudramitra portal (mudramitra.in)

- BIL/RBC application form (asked by some banks)

- Business plan (make sure that it is working and convincing)

- Identity Proof i.e. Aadhaar Card/PAN Card/Driving License/Passport etc

- Residential proof like property tax receipt, rent agreement (if), recent telephone bill, electricity bill etc.

- Recent photograph or less than 6 months old picture of the applicant along with age proof or birth certificate.

- Quotation of items to be purchased or intentions of spending the loan.

- Identity and address proof of the business like business license, tax registration, company registration number (if) etc

- In cases of SC/ST/OBC/Minority, you will need to submit proof of category.

- Bank State of last 6 to 12 months (as per bank T&C)

Conclusion

The initial documents required to apply for the loan varies from bank to bank. Therefore it is suggested to visit two to more banks for better results and conclusions. Always remembers, there are no agents or middlemen hired for MUDRA loan. Beware of those people posing as agents of MUDRA.